Oops! We could not locate your form.

Moving to Singapore: Ultimate Guide

Did you know that an incredible 40 per cent of the total population of Singapore was born abroad? Per capita, this Southeast Asian country has more foreigners than almost anywhere else in the world. Expat families and single migrant workers have been moving to Singapore from across the globe in record numbers for years.

This prosperous, well-maintained Asian nation has always been a true melting pot of cultures. The port city has a strong population of ethnic Chinese, Indian, and Malay residents who live and work alongside immigrants from every part of the globe.

Few counties offer an extraordinarily high standard of living as Singapore, but what is it really like to live there on a daily basis? Let’s dive into the basics of what to expect before you arrive.

Living / Lifestyle

Immigration in Singapore

With a population of 5.7 million, Singapore has welcomed in around 2.16 million immigrants. In a country with one of the world’s lowest birth rates, the government and population alike are well aware of the need to attract foreigners to build, or even maintain, the population.

Home to one of the most significant economies in Asia, Singapore offers work opportunities to immigrants with every type of background. From domestic labourers to skilled technicians, there is a real need to bring in help for every sector.

Recognising their value, Singapore is known for being highly welcoming to foreigners and culturally accepting. In fact, a recent survey found that the majority of Singapore natives believe that they can learn from immigrants. In response to the ethnic enclaves and ex-pat communities, they did note, however, that many foreigners do not fully ingredients into the local Singaporean life. Living in the country, you will find areas with high concentrations of foreign communities, as well as areas where immigrants are living amongst locals.

What Is It Like to Live in Singapore?

Forget about Switzerland. When it comes to having a timely and organised culture where everything works like clockwork, you will find it right here.

Ranking within the top ten safest countries in the world, it is easy to get around and live in this small island city-state. Public transport is convenient and inexpensive. The weather is consistent – though you have to be ready for the tropical heat and humidity!

The hybrid culture of Singapore is such a mix of Eastern and Western cultures that ex-pats from around the globe are able to have a fairly minor transition to local life. Singapore is widely considered to be an easy transition for Indians moving to Singapore. Meanwhile, the imported culture of food, language, and business norms make it easy for North Americans and Europeans to acclimatise quickly.

Cost of Living

What Is the Cost of Living in Singapore?

The cost of living in Singapore is famously high. Even coming from an expensive city like Dubai, you will find that your housing costs will be about 25 per cent higher. Groceries can be nearly 40 per cent more expensive. While local wages can make it well worth the high cost and increase your international purchasing power, it is essential to be well aware of the living cost when deciding on a new job or planning for the cost of moving.

Before the cost of housing, you can expect your monthly expenses to be around 800 Singapore dollars or 590 US dollars for a single person. Moving with a family? The typical family of four will spend around 4,400 Singapore dollars or 3200 US dollars per month, excluding housing costs.

If you are moving to Singapore alone for work and looking to save money, you can rent a single room on your own from the Singapore government’s Housing and Development Board (HDB) for anywhere from S$500 to S$800 (360 USD to 590 USD). If you are looking for a room in a privately owned place in Chinatown, East Coast, or River Valley, you can expect to pay around S$800 to S$1,800 (590 USD to 1325 USD).

If you are moving with your family, you will find a wide price range. When you are looking for a three-bedroom apartment outside of the city centre, you can expect to pay S$3500 (3500 USD). If you are looking at a three-bedroom home in a central location, you can expect to pay around S$6100 (4500 USD).

The public transportation network makes getting around the entire city very easy, even if you are travelling as a family. Unless you have the budget and love the atmosphere of a particular area, most ex-pats don’t find it worth breaking the bank to get into the absolute heart of the city. Almost anywhere in Singapore will be well-connected so being in one specific neighbourhood is not all that important.

Moving to Singapore

What Moving Documents are Needed For Moving to Singapore?

- Copy of passport (photograph and personal information pages)

- Declaration of facts form

- Original bill of lading (OBL) / air waybill (AWB)

- Copy of the owner of the goods’ employment pass / green card (both sides)

- Goods and services tax relief form (GST)

- Supplementary Customs declaration form

- Wine and liquor declaration form

- Certificate of compliance

- Original commercial invoice

- Insurance papers

- Vehicle registration certificate

- Owner of the goods’ passport

- Inward declaration permit

- Customs in-payment permit

- Customs duty payment receipt

- Temporary certificate of entitlement

- Manufacturer’s letter confirming the date the automobile was manufactured

- Import license from the Agri-Food and Veterinary Authority of Singapore (AVA)

- Reservation for quarantine (if applicable) must be made prior to import

For more information on restricted and prohibited items and a more in-depth look at documentation please check the International Association of Movers.

Legal / Visas

Visas in Singapore

Are you looking to work in Singapore? If you are moving to enhance your career opportunities, you will have a range of different options.

Getting an Employment Pass

For ex-pats moving to Singapore, the Employment Pass is a popular option for a working visa. If you are going to be earning at least $3,900 Singapore dollars per month from your new locally-based employer and you have the expected qualification for your field, this can be a great option.

While the typical Employment Pass in Singapore is tied to an employer, there is also an option for a Personalised Employment Pass that offers more flexibility. If you are a highly-skilled professional with the potential to make at least $18,000 Singapore dollars per month, this could be an option. Do note that the first visa is valid for up to three years but, unlike the standard Employment Pass, it is not eligible for renewal. You can read all of the details and get started on the Singapore government’s Ministry of Manpower (MOM) site.

Getting an EntrePass

If you are an entrepreneur looking to start a business in Singapore, you may be able to apply for an EntrePass. Read through all of the requirements and see if your potential business is eligible for a visa.

Skilled and Semi-Skilled Work Visa in Singapore

For ex-pats who work mid-level skilled jobs that pay at least $2,400 Singapore Dollars per month, the S Pass is a good option. The visa is valid for two years and can be regularly renewed. Read about it on the government Ministry of Manpower website, then check to see if you are qualified. If this is a good option for you and you are able to find a Singapore employer, they will be able to complete the visa process for you.

Other Singapore Visa Options for Students and Workers

If you are moving to Singapore to work in a semi-skilled field, as a domestic worker, nanny, or performing artist, there are a range of specialised visa options available. For a complete list, check out the Skilled and Semi-Skilled Worker on the Singapore government’s MOM website.

Singapore Work Visas for Trainees and students

If you are moving to Singapore for professional training that will pay at least $3,000 Singapore dollar per month, you may qualify for a Training Employment Pass. For foreign students and graduates doing training programs of up to six mothers, there is a Training Work Permit Option.

For foreigner students between the age of 18 to 25 who are looking to live and work in Singapore for a six-month working holiday, there is a Work Holiday Pass. For Australian students and graduates between age 18 to 30, there is also a Work Holiday Pass option for one year.

For a complete overview of all of the options for trainees and students, visit the Singapore MOM site.

Money & Taxes

How to Open a Bank Account in Singapore?

Opening a bank account as a foreigner became slightly more complicated in 2018, but it is still entirely possible. In order to open a local bank account, you will need to supply the following documents:

- You passport

- Proof of Singapore residency visa. Any of the following are valid:

- Local ID (National Registration Identity Card or NRIC) issued to any foreigner that is a Permanent Resident (PR) in Singapore

- Employment Pass (EP) issued to a skilled employee of Singapore companies

- Dependant Pass (DP) issued to a family member of an EP holders

- Long-Term Visit Pass issued to a family member of Singapore PRs

- Proof of your Singapore home address (e.g. utility bill, employment letter)

- A reference letter from an existing bank where you opened a personal account

- Proof of the source of funds (for Private Banking accounts)

How Do Taxes Work in Singapore?

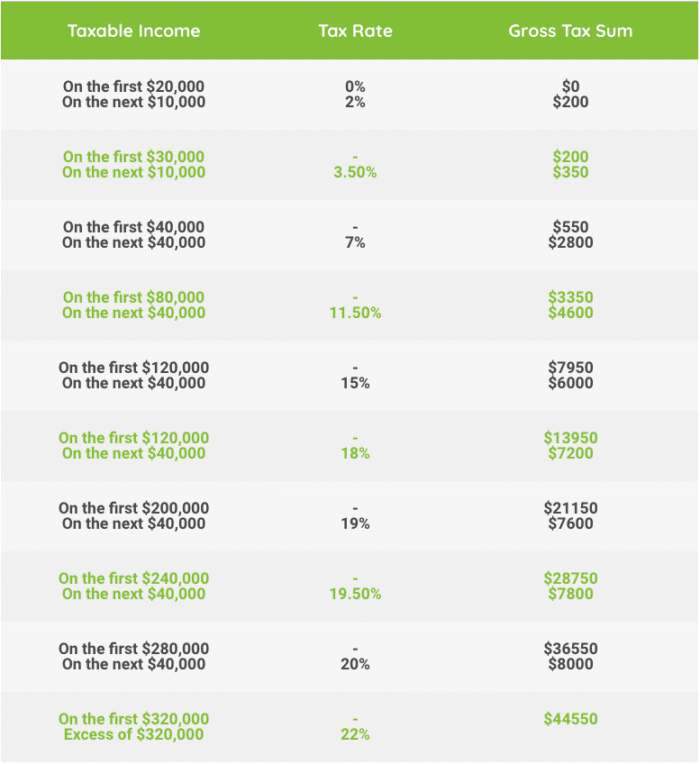

The tax rate in Singapore is a progressive resident tax rate that starts out at zero per cent then extends to 22 per cent for income above S$320,000.

Here is the current rate by income amount:

For a complete picture of the current tax rate and exemptions, visit the Inland Revenue Authority of Singapore website.

Climate & Weather

What’s the Weather like In the UK?

Located near the equator, the climate is tropical and warm giving Singapore lovely weather year-round. During any month of the year, you can expect temperatures between the mid-20s and the low 30s.

There is a possibility of rain throughout the year and typical you will find relatively high levels of humidity. The country sees two monsoon seasons broken up by two inter-monsoonal periods. From December to early March, there is the Northeast Monsoon season, then from June to September, Singapore experiences the Southwest Monsoon season.

Buying & Renting a Home

How to Rent a Home in Singapore?

The general rule of thumb in Singapore is to start looking for a place to live about two months before you want to move house. If you are just moving to Singapore from abroad, you will want to plan for three months of searching and organising if possible.

The housing market in Singapore is probably quite different from what you are used to in your home country or anywhere else you have been living abroad. One of the unique aspects is the extent of government housing. In Singapore, you will find that about 80 per cent of all properties are owned by the government’s Housing and Development Board (HDB). These homes are available to foreigners are typically lower cost than comparable privately-owned property.

In addition to the HDB housing, you will find a section of serviced apartments and condominiums that are popular with ex-pats and foreigner works.

The majority of owners prefer to work with agents rather than tenants searching on their own place. When you are renting for the first time in Singapore, it is usually worthwhile to work with a professional who understands the highly regulated and district housing norms. A few of the common agencies include PropertyGuru, STProperty, Huttons Asia, and Orangetee.

Can Foreigners Buy Property in Singapore?

You can indeed buy a property as a foreigner in Singapore. Under the Residential Property Act, you are able to choose public housing or private property. There is a range of conditions that may require approval from the Singapore Land Authority (SLA) and each property will come with its own unique terms and conditions. For a complete picture of what to expect, read the helpful tips from a local agency.

Healthcare

How Does Healthcare Work in Singapore?

Both the public and private hospitals in Singapore are ranked amongst the best in the world. People from around the globe travel here specialised care. Meanwhile, all citizens of the county, as well as permanent residents, receive subsidised care at public head care facilities.

It is crucial to note, however, that ex-pats on work visas in Singapore do not qualify for subsidised healthcare. For this reason, most ex-pats in the country take out private healthcare. This is a great option for ex-pats working for a short time in the country as well as immigrants waiting to get their permanent residency.

In addition to providing care for those ineligible for government-subsidised options, many Singaporeans take out private healthcare because it gives access to specialised services and offers patients a shorter wait time. For private options, you will find that most are within the Parkway Pantai and Raffles Medical Group networks.

When choosing private health insurance in Singapore, there is a wide range of options available from AIA, Aviva, AXA, Great Eastern, NTUC Income and Prudential health insurance companies. Depending on a variety of factors, you will see plans ranging anywhere in cost from 100 to 400 Singapore dollars per month.

Children / Education

How Does Education Work in Singapore?

Singapore is a great place for families. In most public and private schools, English is the primary language of instruction. In both private and public school, you will find a highly diverse student body. For these reasons, most ex-pat families immigrating to Singapore find it to be a welcoming place where kids adjust quickly.

Expat families who only intend to stay for a year or two often opt for international schools to ensure that kids can easily transfer to another school abroad. If you are an immigrant planning to stay long term, the public school route is the better option.

Singapore’s public education system is consistently ranked amongst the very best in the world. Preschool options are available from age three then compulsory education begins at age six. Any parents looking to begin a homeschool programme must get permission from the government.

Primary school continues until kids are around 12 years old, at which point they take a Primary School Leaving Examination (PSLE) which tests their skills in English, their mother tongue, mathematics, and science. Depending on the results of the test, students then move on to one of four different secondary schools.

While there are different so-call bands for secondary school, all schools follow the same national curriculum for from ages 12 to 16. Rather than different curriculum, the bands present different levels of difficulty, more or less. In each band, there is a focus on English, mother tongue, literature, history, mathematics, science, geography, arts, technology, and home economics.

For full details on the educational system in Singapore, you can find everything you will need to know on the Ministry of Education website from the Singapore government.

Final Thoughts

Whether you are moving for a year or a lifetime, living in Singapore is sure to be the adventure of a lifetime. With world-class education and healthcare options, safe streets, and incredible career opportunities, it is the perfect home for single ex-pats looking for a change as well as families looking to permanently immigrate.

Ready to start seriously planning your move? You need our in-depth guide to renting in Singapore: What to Know Before You Rent: Housing in Singapore.

Moving to a new country can be a little disconcerting, and left unchecked these feelings can develop into anxiety and stress. Moving to Singapore, as we have seen, brings with it both exciting opportunities with some potential challenges. However, embracing the changes and adopting a proactive approach through the advice, tips and links we have provided sets you firmly on course to a successful relocation to Singapore.

Why not get things moving by completing our simple form, enabling international movers to start work on your moving quotation, today!